Income Tax Declaration SOP - வருமான வரி கணக்கீடு - IFHRMS மூலம் பதிவேற்றம் செய்வதற்கான நிலையான வழிகாட்டு நெறிமுறைகள் (SOP) வெளியீடு! - Income Tax Declaration SOP - Income Tax Calculation - Release of Standard Operating Procedures (SOP) for uploading through IFHRMS!

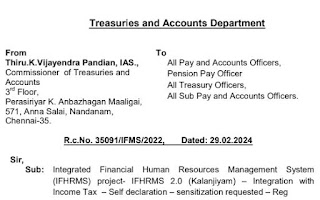

Integrated Financial Human Resources Management System (IFHRMS) project- IFHRMS 2.0 (Kalanjiyam) – Integration with Income Tax – Self declaration – sensitization requested – Reg

Ref: IFHRMS_SOP_Income Tax Declaration, dt: 22.02.2024 ****************

The Kalanjiyam(IFHRMS 2.0) is upgraded with the latest & robust technologies & equipment’s in vogue and successfully gone live from 02nd Jan 2024.

In Kalanjiyam, a new tool has been introduced for automatic calculation of the individual’s income tax based on the estimated Pay and the proposed savings/exemption declared by the Individual for the Financial year.

This will facilitate proportionate monthly deduction of Income tax as per the Income Tax act. The individual can franchise the option in the employee/pensioner self service module.

In case of non submission of self-declaration by the individual in the month of march(during 1st to 10th of March) the new tax regime will be consider as default option. The actual income along with proper proof of document for the investments/claims can be produced in the month December(during 1st to 10th of December) and the income tax will be automatically get revised and remaining income tax will be deducted in the last three month of the

financial year(i.e. December, January & February). The SOP and path for submission of self-declaration has been updated in the Kalanjiyam(IFHRMS 2.0) portal also.

Hence, the Pay and Accounts Officers/Pension Pay Officer/Treasury Officers are requested to sensitize the DDOs to obtain the self-declaration from employees/pensioners for selection of tax regime, declaration of estimated savings and other deductions on or before 10th March every year. CLICK HERE TO DOWNLOAD நிலையான வழிகாட்டு நெறிமுறைகள் (SOP) PDF

No comments:

Post a Comment

கல்விச்செய்தி நண்பர்களே.. வாசகர்களின் கருத்து சுதந்திரத்தை வரவேற்கும் இந்தப்பகுதியை ஆரோக்கியமாக பயன்படுத்திக் கொள்ள அன்புடன் வேண்டுகிறோம்.